Illinois Tax Bracket 2025

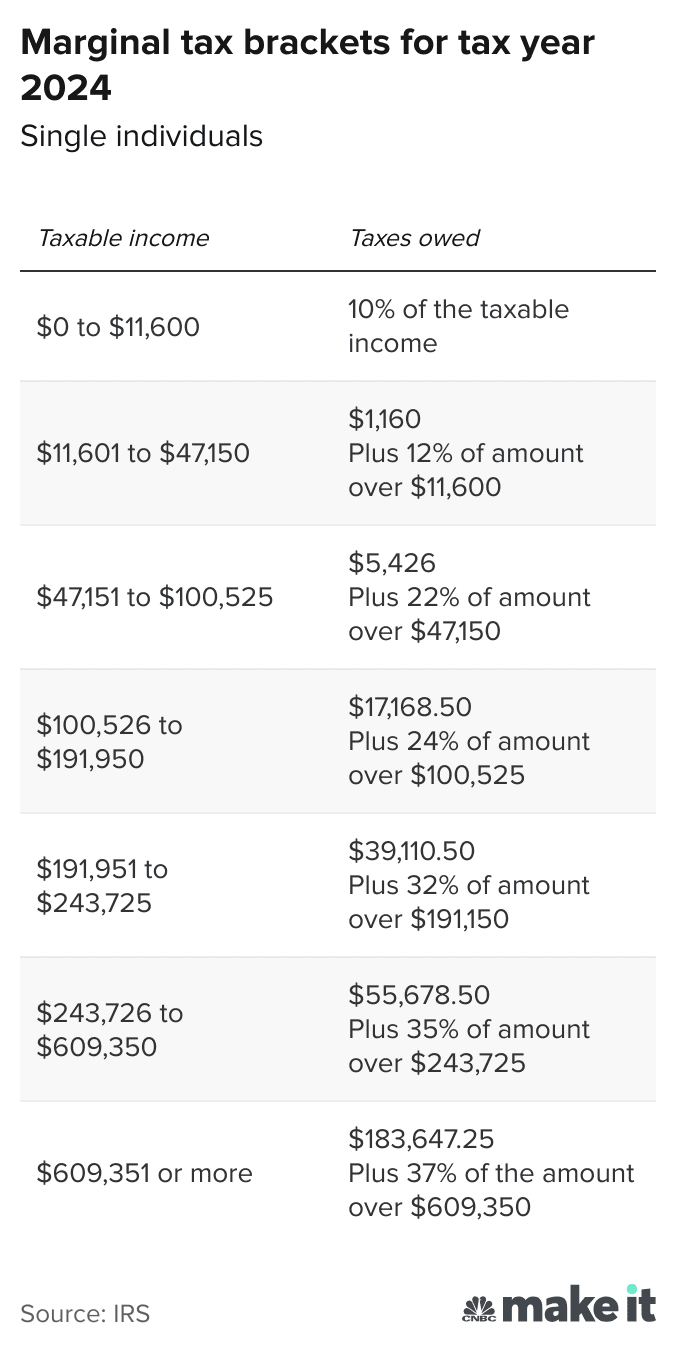

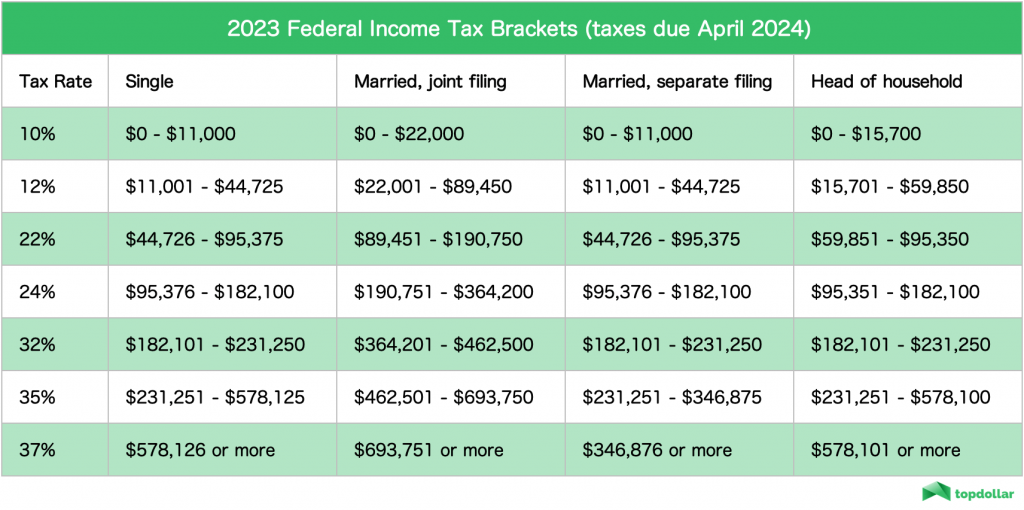

Illinois Tax Bracket 2025. Unlike the federal government and many other states, illinois does not have tax brackets that impose higher rates on. The highest individual tax bracket is 37%.

The illinois department of revenue (idor) announced that it will begin accepting and processing 2025 tax returns on january 29, the same date the internal.

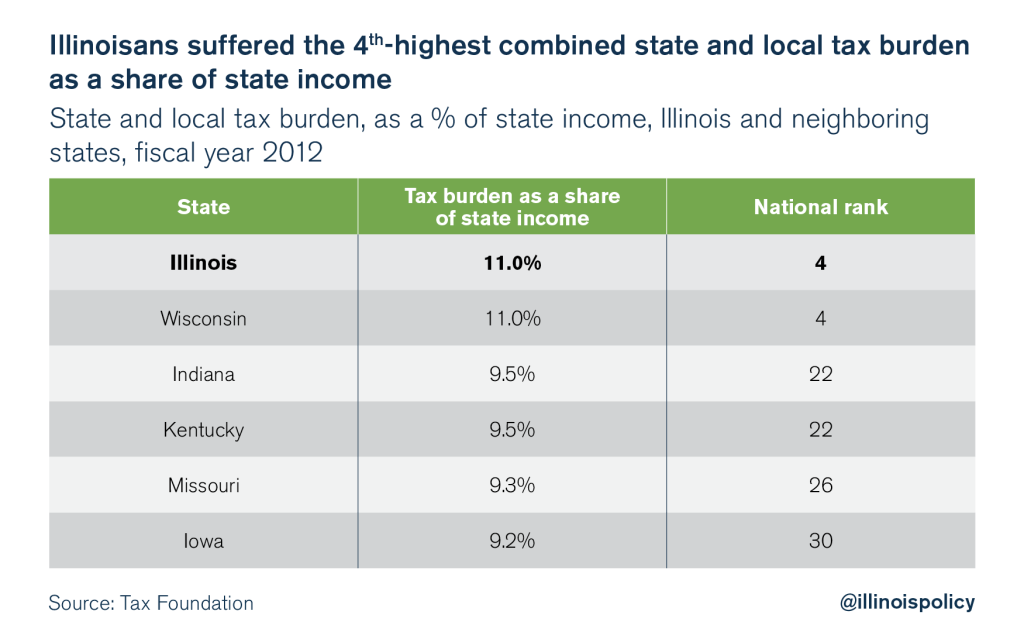

What Are The Different Tax Brackets 2025 Eddi Nellie, Spending a ton of money. Effective january 1, 2025, certain taxing jurisdictions have imposed a local sales tax or changed their local sales tax rate on general merchandise sales.

Cut Taxes, Raise Revenue Can Illinois' Tax Plan Work for Colorado?, March madness 2025 had its share of upsets in the first round, with underdogs like no. The tax tables below include.

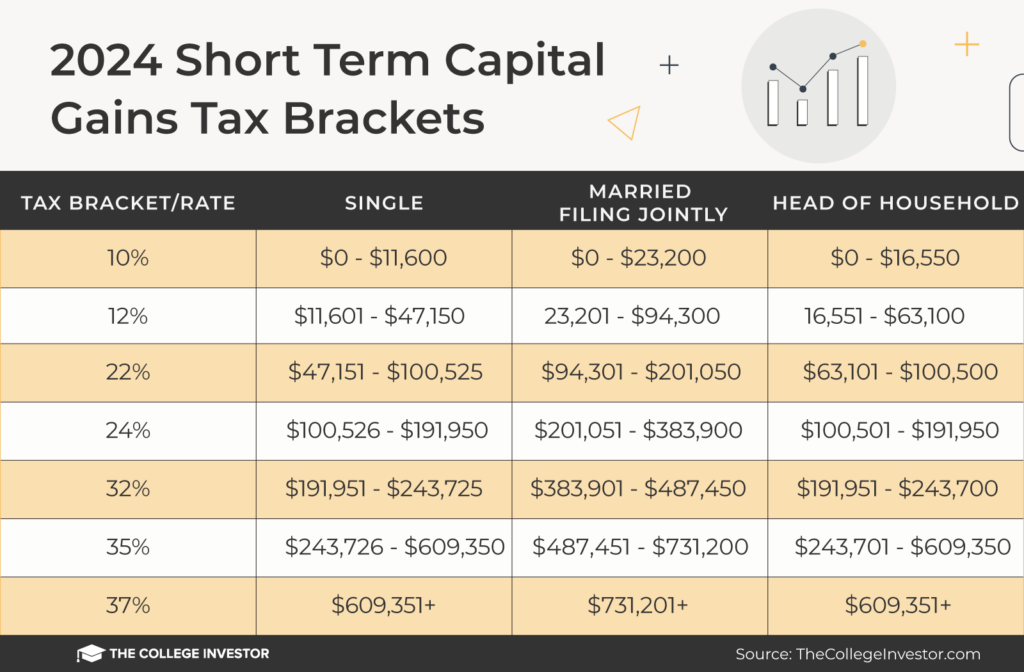

20242024 Tax Calculator Teena Genvieve, In 2025, it applied to any income beyond $578,125 for single people. And not spending a ton.

Here are the federal tax brackets for 2025 vs. 2025 Narrative News, Tax season is officially underway. Up to $23,200 (was $22,000 for 2025) — 10%;.

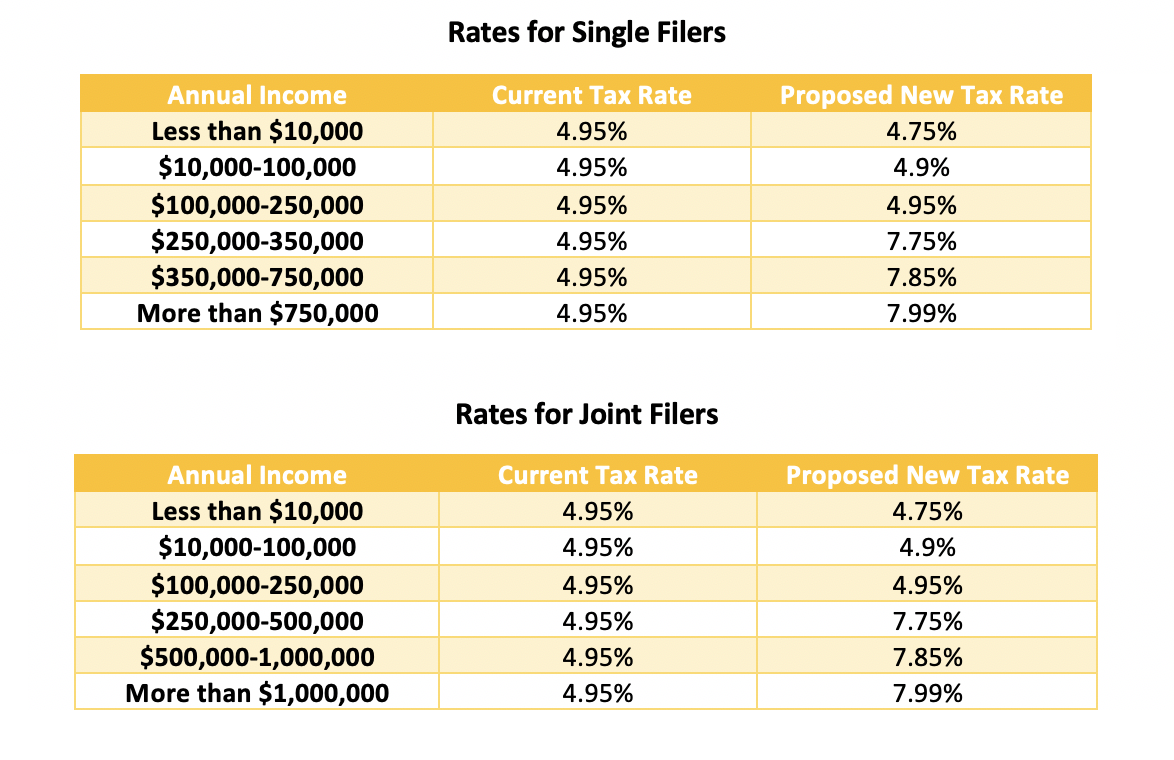

How To Calculate Paycheck After Taxes In Illinois, For married people filing jointly, the top rate kicks in. The illinois income tax rate is a flat 4.95%.

New For 2025 Taxes Teri Abigael, Illinois' 2025 income tax brackets and tax rates, plus a illinois income tax calculator. The latest state tax rates for 2025/25 tax year and will be update to the 2025/2026 state tax tables once fully published as published by the various states.

IRS Tax Brackets AND Standard Deductions Increased for 2025, For married people filing jointly, the top rate kicks in. Changes for 2025 illinois income tax.

Capital Gains Tax Brackets For 2025 And 2025, In 2025, it applied to any income beyond $578,125 for single people. Tax season is officially underway.

Tax Rates 2025 To 2025 2025 Printable Calendar, This year, the eitc has expanded eligibility to include taxpayers 18 years of age or older (with or without qualifying child), those 65 years of age or older (without. The illinois tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in illinois, the calculator allows you to calculate income.

Irs Tax Brackets 2025 Chart Printable Forms Free Online, Your 2025 federal income tax comparison. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.